Monthend Process |

Following the final billing at the end of the month, the process to balance out and/or close the billing period allow you to report on the monthly sales, cash receipts, adjustments and account balances with the option to interface your General Ledger account numbers. Also see Logged Activities, Monthend Reporting, Journal vs. Listing .

Your General Ledger is your accounting program while TRUX will serve as your sub-ledger if your company chooses to utilize this optional feature of the program. General Ledger account numbers can be assigned to allocate revenue sales, cash and adjustment using G/L Interface. If G/L Interface will not be used, proceed to How To Balance Out at Monthend.

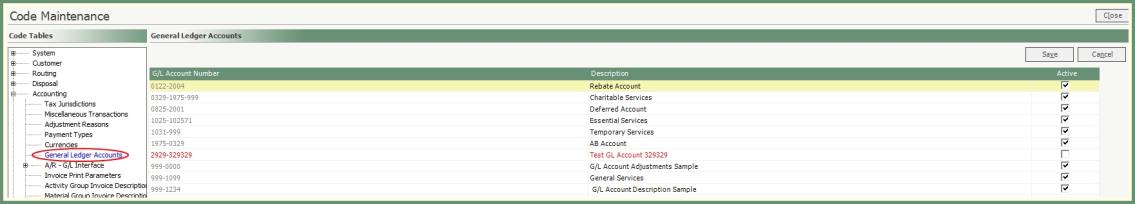

Navigate To: System>Configuration>Code Maintenance>Accounting>General Ledger Accounts

- Enter a G/L Account Number.

- Enter a Description for the G/L Account Number.

- Active will be assigned by default.

- G/L Account Numbers cannot be deleted but can be set as inactive by removing the active flag. Inactive G/L Account Numbers will display in red.

- Repeat for each General Ledger Account needed and save.

- Proceed to A/R - G/L Interface.

Also See: Enforce GL Account on Adjustments

- Select each category within the G/L Interface section that will be used to report by G/L accounts.

- Populate each field according to the column headers. Customer Types, Materials, Service Types, etc...

- Assign the associated G/L Account Number to each field type description.

- Repeat until all of your associations are complete and save when finished.

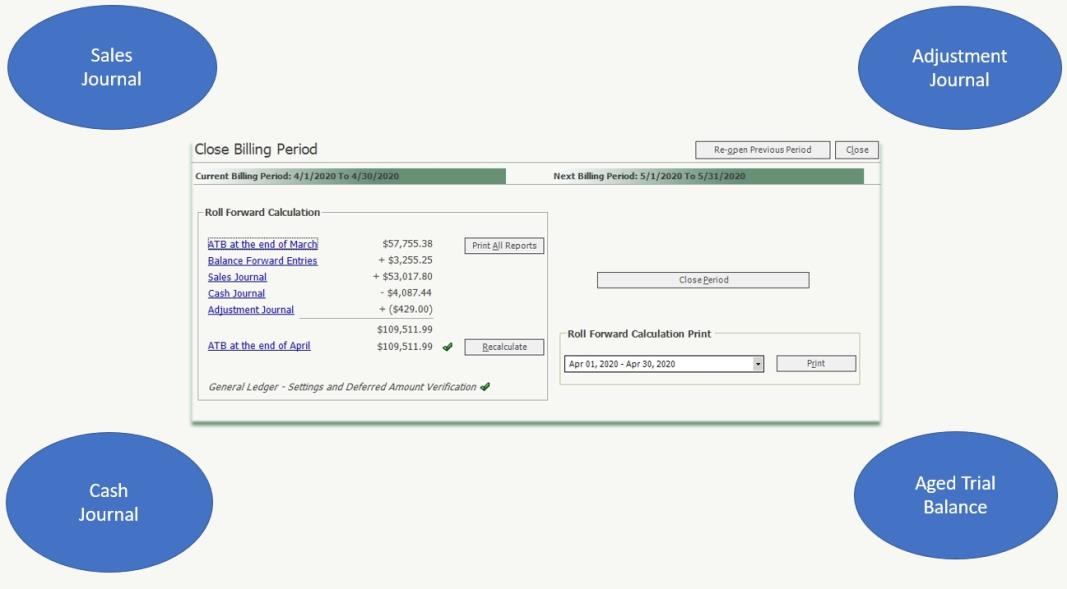

How To Balance Out at Monthend

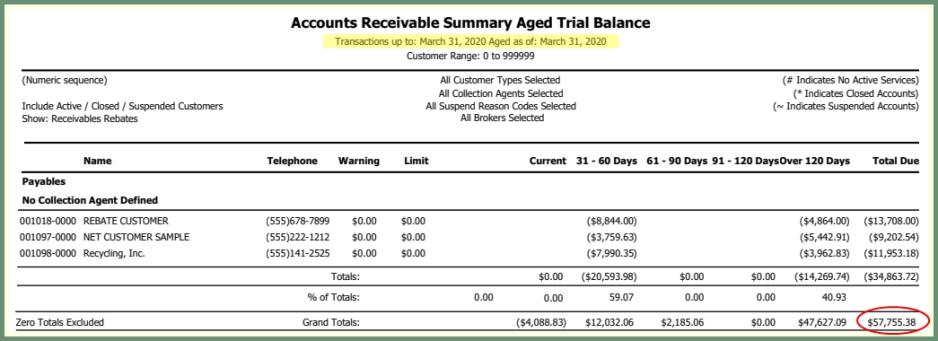

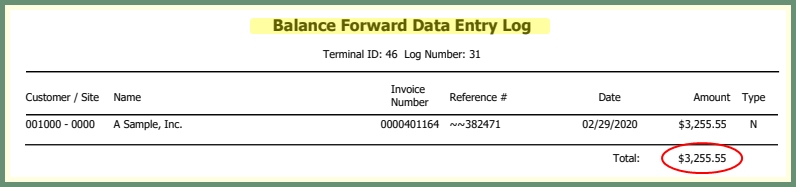

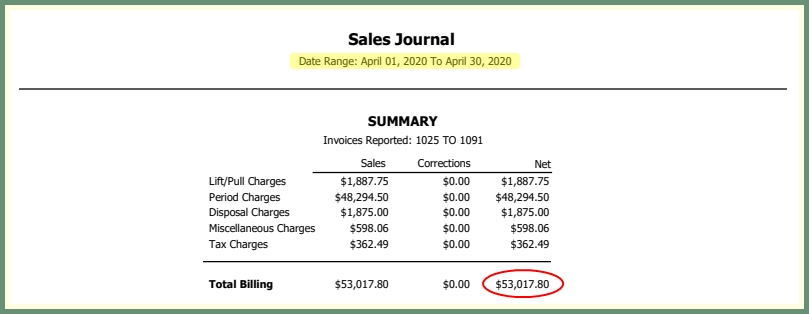

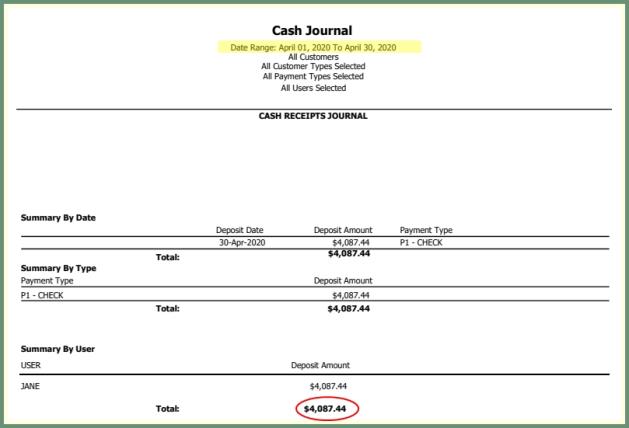

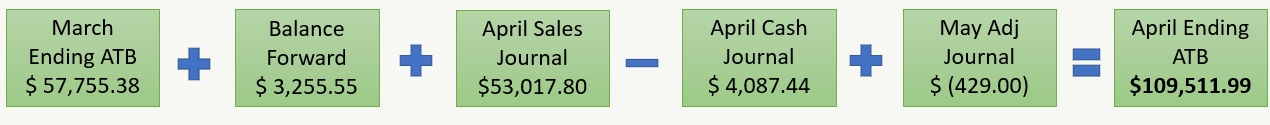

Previous Month ATB + Balance Forward Entries (if any) + Sales Journal - Cash Journal + Adjustment Journal=Current Month ATB

- Complete the final billing , balance forward entries, cash receipts and adjustments for the current month.

- Recall the .

- Recall .

- Generate a .

- Generate a .

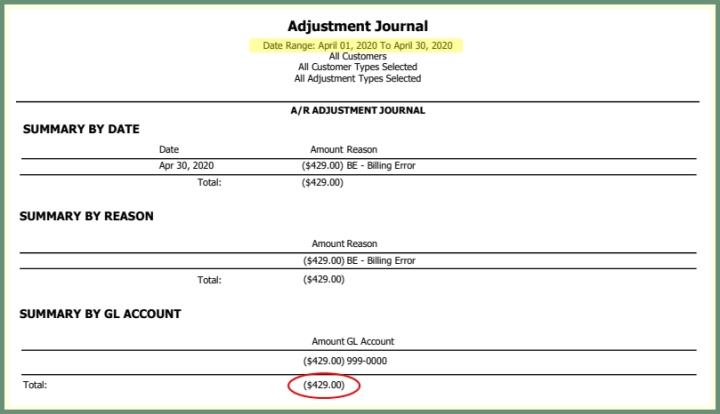

- Generate an .

- Generate an .

Closing the billing period is not mandatory to proceed to the next billing period. However, closing the billing period will prevent any sales, cash and adjustments from posting during a closed billing period and changing the accounting for that month after you have made your final journal entries.

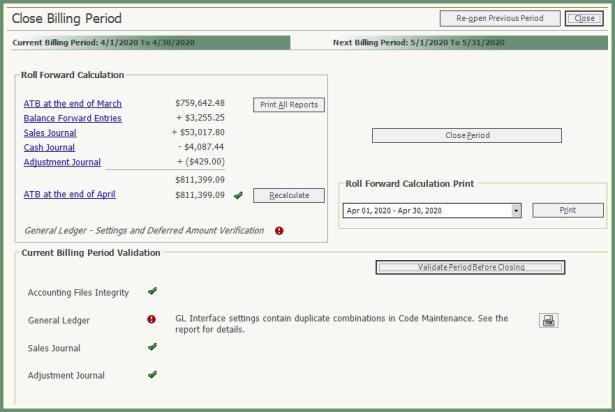

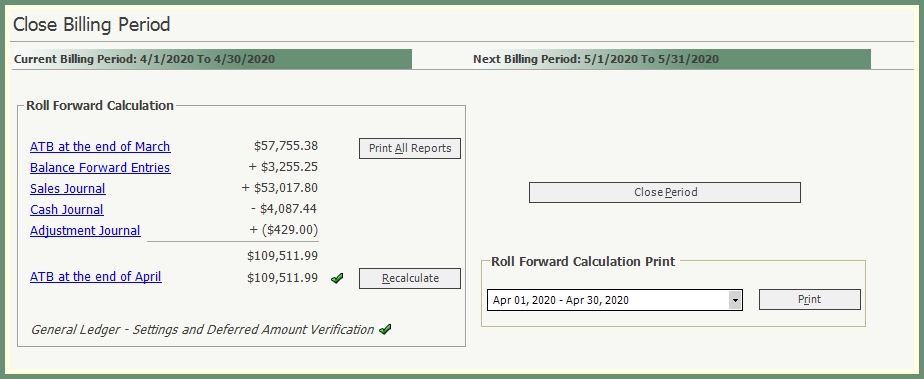

Navigate To: Accounting>Close Billing Period

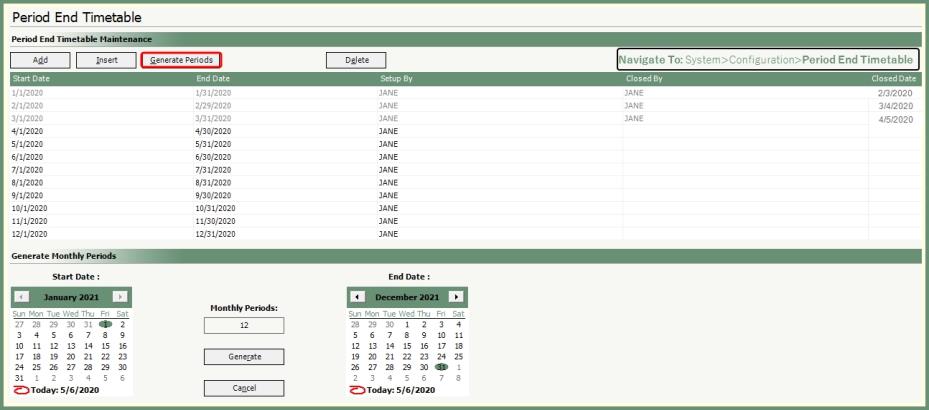

The current and next billing periods will be presented based on the billing periods defined in the .

Current Billing Period: The first open monthly period in the period end timetable.

Next Billing Period: The second open monthly period in the period end timetable.

Roll Forward Calculation: Displays the following totals used to balance out the monthend billing period.

- Previous period ATB ending balance, balance forward entry amount, sales total, posted cash total, posted adjustment total and current period ATB total.

- Click the link to generate a report for any of the totals in the roll forward calculation section.

- Click Print All Reports to generate all reports in the roll forward calculation section.

- Click Recalculate to update the Roll Forward Calculations.

Roll Forward Calculation Print: Select an open period to print the summary of roll forward calculations.

General Ledger Verification: Will indicate a green check if validation is passed or a red exclamation if an issue is found.

- .

- A print button will appear beside files with issues to generate a report on the issue to pursue correction.

- Click Validate Period Before Closing to update the validation status.

Close Period: Click to Close Period the Current Billing Period.

- The period is considered open until the Close Period button is clicked.

- Invoices, payments and adjustments with dates in a closed period will not be permitted.

- An invoice, payment and adjustment can only be created for a date in an open period.

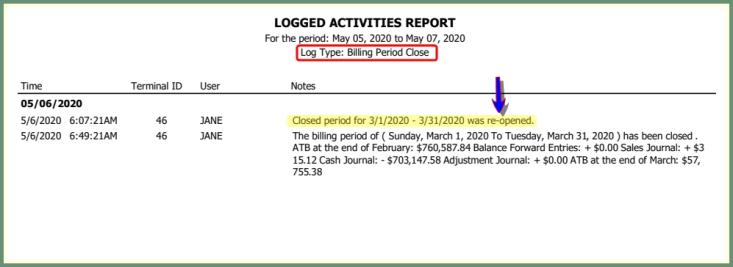

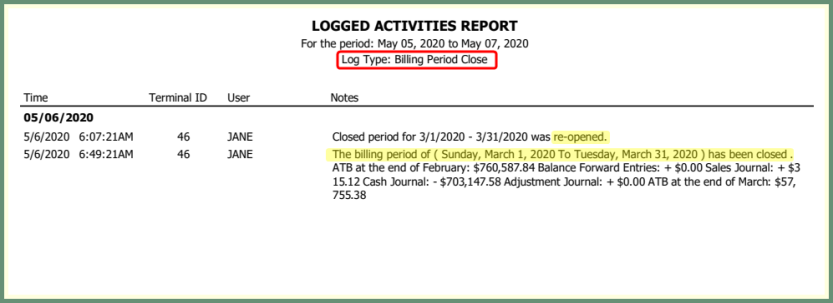

- Closing a Period will be included in the .

Re-open Previous Period: Will change the status of the previous period from closed to open.

- Re-opened Periods will be included in the .

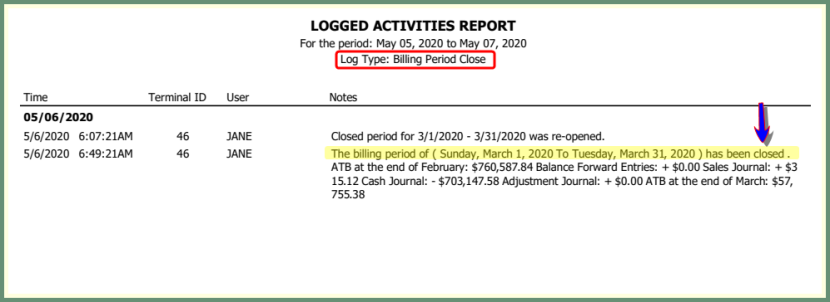

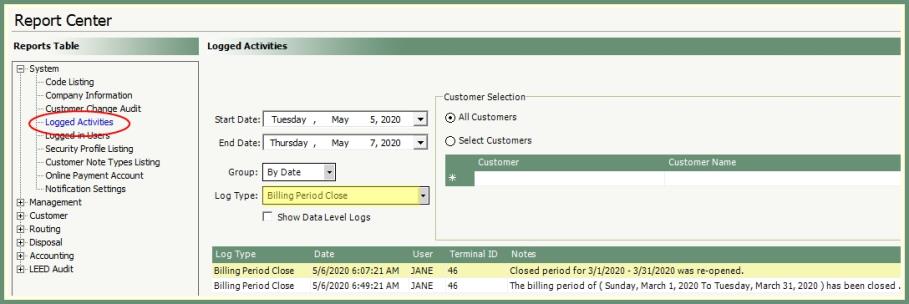

Billing Periods closed and opened will be logged and reported by date, user and action notes.

Navigate To: Report>Report Center>System>Logged Activities

- Select Start and End Date.

- Verify or change the Group by selection.

- Select Log Type: Billing Period Close.

- The grid will populate with billing period close activity by log type, date & time, user, terminal id and notes.

- Select an Output type to generate a

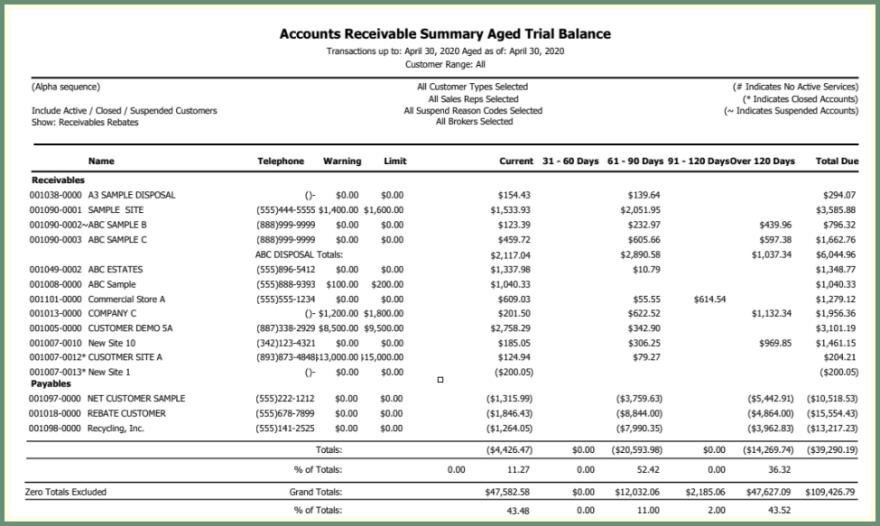

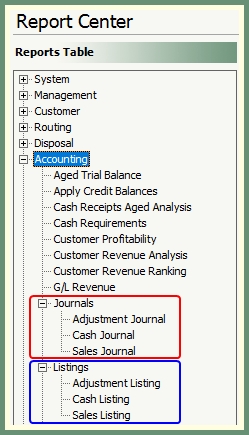

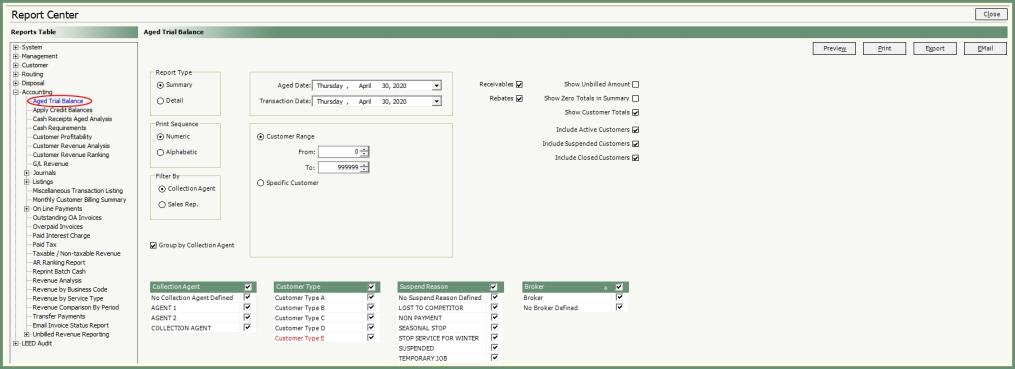

Common reports used during monthend include Aged Trial Balance, Journals and Listings, GL Revenue and/or GL Details Export.

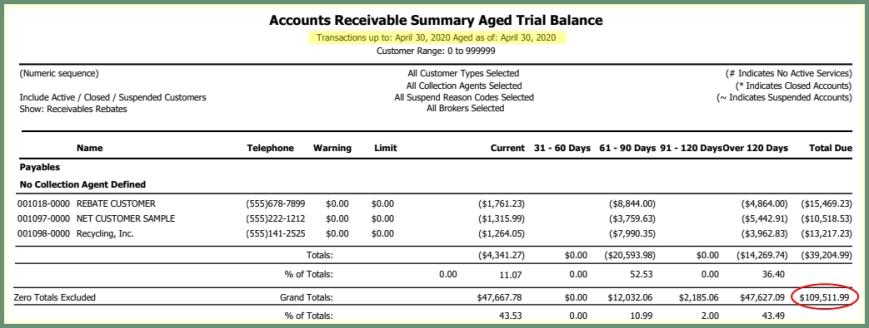

Reporting on accounts for balancing at monthend as well as collection, account receivable & rebate balance and billing reference by specified parameters are available within the Aged Trial Balance.

Navigate To: Reports>Report Center>Accounting>Aged Trial Balance

- Select Report Type, Print Sequence and Filter By preference.

- Optional Group by Collection Agent or Sales Representative based on the Filter By selection.

- Collection Agent/Sales Representative, Customer Type, Suspend Reason, Broker grids will default to all.

- Add/Remove grid selections based on the preferred output.

- For monthend, all grid selections should be enabled.

- Select Aged Date which is the date the account balances will be aged against.

- To balance monthend, the aged date is typically the last date of the month.

- Select Transaction Date which is the date of posted cash, adjustments and invoices will be aged against.

- To balance monthend, the aged date is typically the last date of the month.

- Review and/or modify customer inclusion parameters.

- To include all billed activity in the aging at monthend, all customers are reported.

- Review and enable or disable report output preferences to include or exclude based on the field labels.

- The default selections are typical in monthend balance reporting.

- Select an output to generate an .

Adjustment, Cash and Sales can be produced as a Journal or a Listing. There are differences between both; see the comparison table below.

Navigate To: Report>Report Center>Accounting>

Journal vs. Listing Comparison Table

| Journal | Listing | |

|---|---|---|

| Adjustment |

|

|

| Cash |

|

|

| Sales |

|

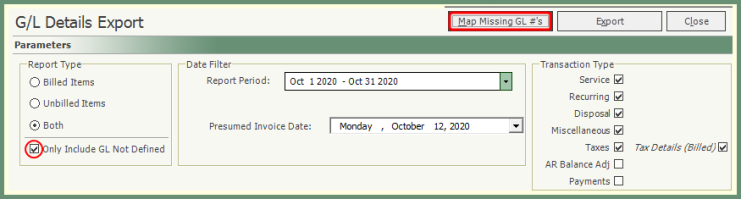

In a simplified table, you can associate each of your defined record type/code/service type/customer type to a single G/L Account.

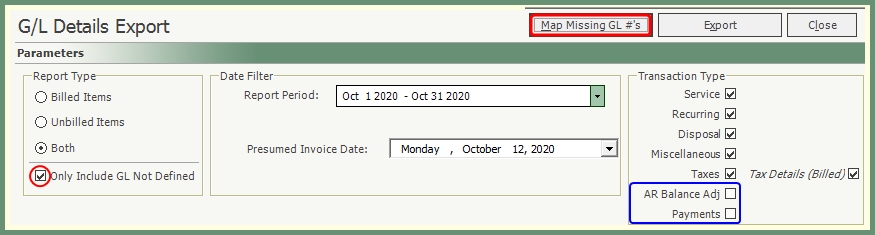

Navigate To: Accounting>G/L Details Export

|

-

For mapping all Record Type combinations to a G/L Account, select Both.

-

Check Only Include GL Not Defined.

-

To only include billable records, remove AR Balance Adj. and Payments Transaction

-

Click Map Missing GL#'s.

-

All unmapped record types within the report period for the selected transaction types will populate the Unmapped Combinations grid.

-

Sort the grid by Record Type, Code or Service Type.

-

Click the G/L Code drop down to apply a G/L Account.

-

Repeat for all unmapped record type combinations and Save.

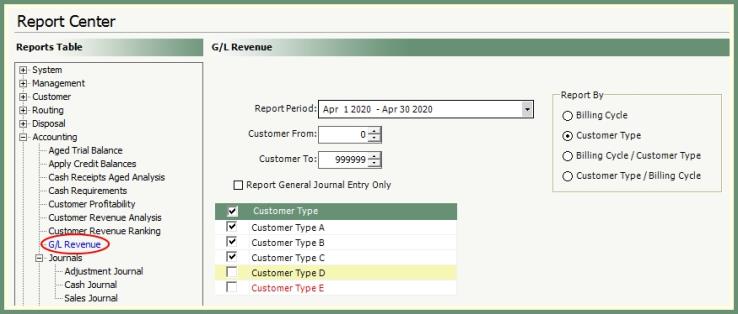

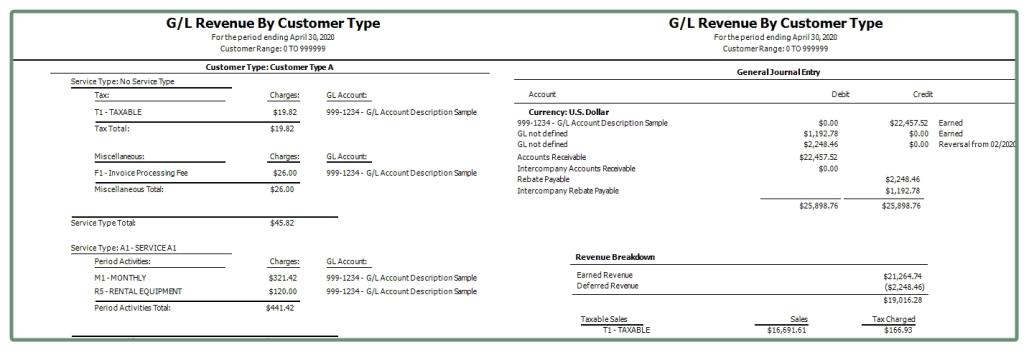

Report on G/L Revenue activity by billing cycle, customer type or both for the current or closed billing period.

Navigate To: Report>Report Center>Accounting>G/L Revenue

- Select a Billing Period to report.

- Verify or enter a customer range.

- Select the optional Report General Journal Entry Only, if applicable.

- Select the radio button to report by Billing Cycle, Customer Type or both.

- The grid will update based on the report by selection. Include or exclude grid fields on the report.

- Select an output.

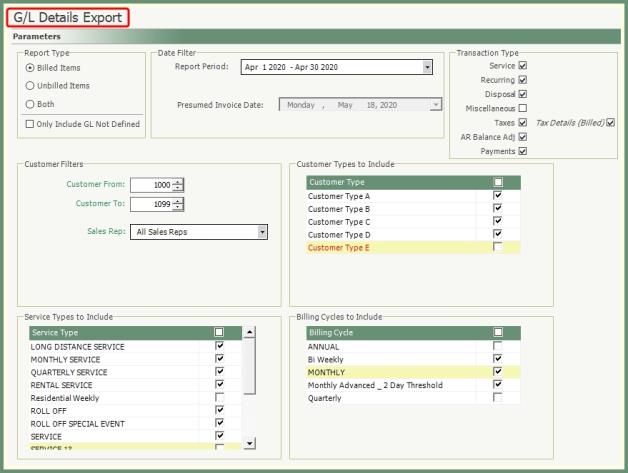

An export of all billed and/or unbilled transactions and the associated general ledger account can be exported to a .csv to be grouped and sorted based on your specified parameters.

Navigate To: Accounting>G/L Export Details

- Select a Report Type.

- Billed Items: Only billed items will be exported.

- Unbilled Items: Only unbilled items will be exported.

- Both: Billed & Unbilled items will be exported.

- Only Include GL Not Defined: If selected, only items without a defined G/L account will be exported.

- Select a Date Filter by Report Period.

- If Unbilled or Both report type is selected, a Presumed Invoice Date should be selected.

- In Customer Filters, enter a customer range to be exported and select All or specific Sales Reps.

-

Typical monthend Transaction Types exclude AR Balance Adj. and Payments. However adjustments and payments can be mapped to G/L accounts and transaction line items included in the export if needed.

- Select all or specified customer types, service types and billing cycles to be exported.

- Click Export to generate a G/L Details .csv. Sort and/or filter the exported data to meet your specified G/L revenue reporting needs.

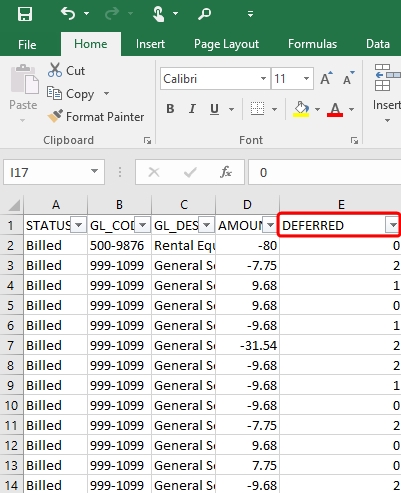

|

|

G/L Details Export Deferred Codes:

The number in the Deferred Column indicates the Revenue is:

0=Earned

1=Deferred

2=Reversed Deferred |

Enforce GL Account on Adjustments